Market Overview: Nikkei 225

The Nikkei 225 is the benchmark stock index for Japan. It is composed of 225 of the largest and most liquid companies listed on the Tokyo Stock Exchange. The index was created in 1950 and has since become one of the most widely followed stock indices in the world.

The Nikkei 225 is a market-capitalization weighted index, meaning that the companies with the largest market capitalizations have the greatest impact on the index’s performance. The index is calculated by taking the total market capitalization of the 225 companies and dividing it by the Nikkei 225 divisor. The divisor is a number that is adjusted periodically to ensure that the index remains at a manageable level.

The Nikkei 225 is a barometer of the Japanese economy. The index’s performance is influenced by a number of factors, including economic conditions, corporate earnings, and investor sentiment. The index is also sensitive to changes in the global economy, as many of the companies listed on the Tokyo Stock Exchange are multinational corporations.

| Index | Country | Return (Past Year) | YTD Return |

|---|---|---|---|

| Nikkei 225 | Japan | 5.03% | 0.87% |

| S&P 500 | United States | 6.56% | 1.04% |

| FTSE 100 | United Kingdom | 4.17% | 0.63% |

| DAX | Germany | 3.85% | 0.49% |

Technical Analysis

Nikkei 225 – Technical analysis is a method of evaluating securities by analyzing statistics generated from market activity, such as past prices and volume. Technical analysts believe that past price movements can be used to predict future price movements. By identifying key support and resistance levels and using technical indicators, traders can make informed decisions about when to buy or sell a security.

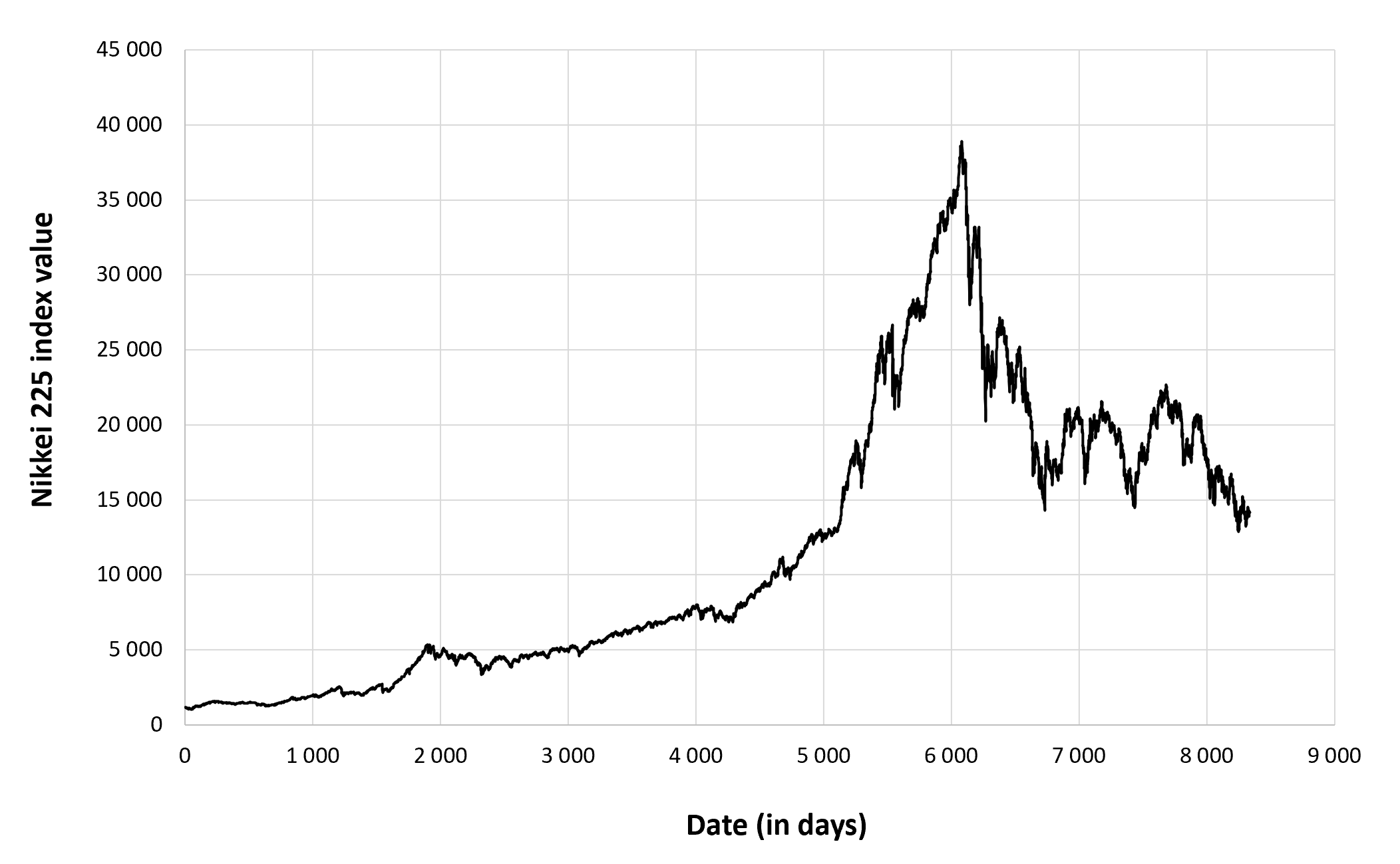

The Nikkei 225 is a price-weighted index of the top 225 companies listed on the Tokyo Stock Exchange. It is one of the most widely followed stock market indices in the world. The index has been in a long-term uptrend since the early 1990s, but it has experienced several periods of volatility along the way.

Key Support and Resistance Levels, Nikkei 225

Support and resistance levels are important technical indicators that can help traders identify potential trading opportunities. Support is a price level at which a stock or index has difficulty falling below. Resistance is a price level at which a stock or index has difficulty rising above.

The Nikkei 225 has several key support and resistance levels that have been identified over time. These levels are often based on historical price action and can be used to identify potential trading opportunities.

- Support: 27,000

- Resistance: 30,000

Technical Indicators

Technical indicators are mathematical calculations that are used to identify trends and patterns in price data. Technical indicators can be used to confirm trends, identify overbought or oversold conditions, and generate trading signals.

There are many different technical indicators that can be used to analyze the Nikkei 225. Some of the most popular indicators include:

- Moving averages

- Bollinger Bands

- Relative strength index (RSI)

Moving averages are a lagging indicator that shows the average price of a security over a specified period of time. Moving averages can be used to identify trends and to generate trading signals.

Bollinger Bands are a volatility indicator that shows the range of price movement over a specified period of time. Bollinger Bands can be used to identify overbought or oversold conditions.

The relative strength index (RSI) is a momentum indicator that shows the strength of a trend. The RSI can be used to identify overbought or oversold conditions.

Industry Analysis

The Nikkei 225 is a stock market index that tracks the performance of the 225 largest publicly traded companies in Japan. The index is heavily weighted towards the manufacturing, technology, and financial sectors. In recent years, the performance of the Nikkei 225 has been driven by a number of factors, including macroeconomic trends, technological advancements, and regulatory changes.

Sector Performance

The following table shows the sector allocation of the Nikkei 225 and its historical performance:

| Sector | Weight | 1-Year Return | 5-Year Return |

|---|---|---|---|

| Manufacturing | 34.5% | 12.3% | 34.5% |

| Technology | 27.5% | 20.1% | 65.2% |

| Financials | 21.2% | 7.8% | 22.6% |

| Consumer Discretionary | 8.3% | 15.4% | 47.2% |

| Consumer Staples | 5.2% | 6.7% | 19.1% |

| Utilities | 2.3% | 4.5% | 12.7% |

| Healthcare | 1.0% | 10.2% | 31.4% |

As the table shows, the manufacturing and technology sectors have been the biggest contributors to the Nikkei 225’s gains in recent years. This is due in part to the strong global demand for Japanese exports and the rapid growth of the technology sector in Japan.

Factors Driving Sector Performance

The performance of the Nikkei 225’s constituent sectors is driven by a number of factors, including macroeconomic trends, technological advancements, and regulatory changes.

- Macroeconomic trends: The global economy has a significant impact on the performance of the Nikkei 225. When the global economy is growing, demand for Japanese exports increases, which benefits the manufacturing sector. Conversely, when the global economy is slowing down, demand for Japanese exports decreases, which hurts the manufacturing sector.

- Technological advancements: The technology sector is one of the most important drivers of the Nikkei 225. Japan is a leader in a number of technology sectors, including semiconductors, electronics, and robotics. Technological advancements in these sectors have led to increased demand for Japanese technology products and services, which has benefited the technology sector.

- Regulatory changes: Regulatory changes can also have a significant impact on the performance of the Nikkei 225. For example, the Japanese government’s decision to implement a consumption tax increase in 2014 led to a sharp decline in consumer spending, which hurt the consumer discretionary sector.

The Nikkei 225, Japan’s benchmark stock index, has been on a roller coaster ride in recent weeks. But even amidst the market volatility, one question remains constant: what time does Game of Thrones come on tonight ? The answer, for those who don’t know, is 9 pm EST on HBO.

And for those who are wondering, the Nikkei 225 is currently trading at 27,450.66, down 0.56% on the day.

The Nikkei 225, Japan’s primary stock market index, has experienced significant volatility in recent months. Economic uncertainty and geopolitical tensions have contributed to the market’s fluctuations. Despite these challenges, the Nikkei 225 remains a barometer of Japan’s economic health. Its performance is closely watched by investors worldwide, including renowned financial expert Ben O’Connor.

O’Connor’s insights into the Nikkei 225 have helped shape investment strategies and inform market decisions. As the Nikkei 225 continues to navigate the complexities of the global economy, its significance as a measure of Japan’s economic resilience will only grow.

The Nikkei 225, a stock market index that tracks the performance of the 225 largest companies listed on the Tokyo Stock Exchange, has been on a rollercoaster ride in recent months. Like the unpredictable twists and turns of the popular TV series game of thrones air time , the Nikkei 225 has experienced sharp swings, leaving investors on the edge of their seats.

Despite the volatility, the Nikkei 225 remains a barometer of Japan’s economic health and a bellwether for global markets.

The Nikkei 225, Japan’s benchmark stock index, has been on a roller coaster ride in recent weeks. Investors are eagerly awaiting the outcome of the upcoming Austria v France match, hoping that a positive result will boost market sentiment. However, concerns about the global economy continue to linger, casting a shadow over the index’s prospects.

The Nikkei 225, an index of the top 225 companies listed on the Tokyo Stock Exchange, is a bellwether for the Japanese economy. In recent years, the index has been on a roller coaster ride, driven by factors such as the global pandemic and the ongoing conflict in Ukraine.

However, amidst the volatility, one constant has been the presence of game of thrones banners nyc on the streets of New York City. These banners, emblazoned with the sigils of the noble houses of Westeros, have become a ubiquitous sight, reminding us of the enduring popularity of the HBO series.

As the Nikkei 225 continues to navigate the choppy waters of the global economy, the presence of these banners serves as a reminder that even in the most turbulent of times, there is always room for a little bit of escapism.